Online fraud detection in the context of mobile applications, particularly for large enterprises such as e-commerce companies or retail banks, refers to the set of practices, technologies, and strategies designed to identify and prevent fraudulent activities conducted via mobile platforms. This concept is integral to safeguarding financial transactions, user data, and overall enterprise reputation.

Importance of Online Fraud Detection for Developers and Enterprises

In mobile application development and device security, online fraud detection is not just a feature but a cornerstone of digital trust and operational integrity. Understanding and implementing robust online fraud detection mechanisms is essential for both developers and enterprises. Here’s an in-depth analysis of why it is so critical.

For Developers

- Protecting User Data: Developers are responsible for safeguarding user data. Fraudulent activities often target personal and financial information. Effective fraud detection mechanisms help identify and mitigate these threats, ensuring user data remains confidential and secure.

- Maintaining Application Integrity: Fraud can undermine the integrity of an application. For developers, ensuring the application is secure from various types of fraud is crucial to maintaining its credibility and functionality.

- Regulatory Compliance: Many industries are regulated regarding data protection and fraud prevention. Developers must ensure their applications comply with laws like GDPR, HIPAA, and others. Failure to do so can result in hefty fines and legal complications.

- Building User Trust: Users are likelier to trust and engage with secure applications. By implementing effective fraud detection, developers can enhance user trust, which is fundamental for the app’s success.

- Preventing Financial Losses: Mobile applications handle numerous transactions, especially in e-commerce and banking. Fraud detection helps prevent unauthorized transactions that can lead to significant financial losses.

- Innovation and Competitive Edge: In a competitive market, offering advanced security features like cutting-edge fraud detection can provide a significant advantage and position the application as a leader in its domain.

For Enterprises

- Financial Impact: Online fraud can have a direct financial impact on enterprises. This impact includes lost revenue from fraudulent transactions and the potential costs associated with remediation, legal fees, and refunds.

- Brand Reputation: A single instance of fraud can damage an enterprise’s reputation, causing a loss of customer trust and loyalty. This reputation damage is especially critical for large enterprises where brand perception plays a significant role in business success.

- Operational Continuity: Fraudulent activities can disrupt business operations. For instance, a data breach can lead to system downtime. Maintaining robust fraud detection practices ensures operational continuity and stability.

- Market Confidence: Investors and stakeholders are increasingly concerned about cybersecurity. Effective fraud detection strategies demonstrate to the market that the enterprise is proactive about risk management.

- Scalability and Adaptability: As enterprises grow, they become more attractive targets for fraudsters. A scalable fraud detection system can adapt to increasing volumes of transactions and evolving threats, protecting the enterprise as it expands.

- Legal and Regulatory Obligations: Enterprises must adhere to strict compliance standards, especially in regulated sectors like finance and healthcare. Fraud detection is often a regulatory requirement, and non-compliance can lead to severe penalties.

For developers, integrating fraud detection is integral to creating secure, reliable applications that protect user data and maintain trust. For enterprises, it’s about protecting their financial interests and reputation and ensuring regulatory compliance. In the digital age, where mobile applications are an essential part of everyday life, online fraud detection is not just a security measure but a fundamental aspect of sustainable and responsible digital business practices. It’s an investment in trust, security, and long-term success.

Understanding Online Fraud Detection: Types of Fraud in Mobile Applications

Understanding the various types of fraud in mobile applications is crucial for developers, as it directly impacts the design and security measures implemented during development. This knowledge is not just about reacting to fraud but proactively preventing it. Here, we explore the main types of fraud encountered in mobile applications and their implications for developers.

- Identity Theft and Account Takeover: Identity theft and account takeover involve unauthorized access to a user’s account, often through stolen credentials or social engineering tactics. To mitigate this, developers must implement robust authentication mechanisms like two-factor authentication (2FA), biometric verification, and robust password policies. Regularly updating and auditing security protocols is essential.

- Payment Fraud: Payment fraud includes unauthorized transactions, using stolen credit card details, or exploiting payment system vulnerabilities. Secure payment gateways, transaction data encryption, and integrating fraud detection systems that monitor unusual transaction patterns are critical.

- Data Breaches: Data breaches occur when sensitive user data is illegally accessed or extracted, often due to inadequate security measures. Developers must ensure data is encrypted both at rest and in transit. Regular vulnerability assessments and adherence to data protection regulations like GDPR and HIPAA are crucial.

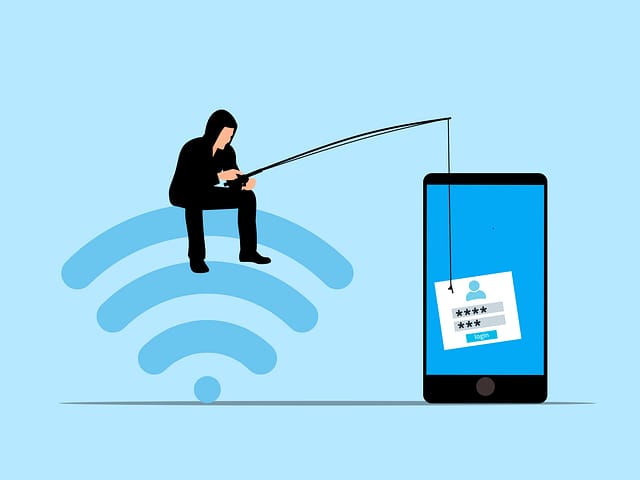

- Phishing Attacks: Fraudsters trick users into providing sensitive information through fake interfaces or malicious links. Incorporating features that educate users on secure practices and detecting and warning users about potential phishing within the app is essential.

- Malware and Ransomware: Malicious software is used to disrupt operations, gain unauthorized access, or extort money by encrypting data. Robust security protocols, regular software updates, and educating users on downloading apps from trusted sources are vital preventive measures.

- Fake Applications: Fraudsters create counterfeit applications that mimic legitimate ones to steal data or money. Vigilance in monitoring for counterfeit versions and rapid response strategies is essential. Also, educating users on how to identify legitimate apps is beneficial.

- Ad Fraud: Ad fraud involves manipulating advertising networks to generate revenue fraudulently. Implementing and maintaining transparent ad delivery systems and monitoring for unusual traffic patterns can help combat ad fraud.

- Insider Fraud: Fraud committed by employees or associates with access to the company’s resources or sensitive information. Role-based access controls and monitoring employee activities are crucial in mitigating this risk.

Why Understanding Online Fraud Detection is Important for Developers

- Risk Mitigation: Developers with knowledge of potential fraud types can implement targeted security measures, reducing the risk of successful attacks.

- Regulatory Compliance: Understanding fraud types is vital for compliance with various data protection and privacy regulations, which is essential for enterprise-level applications.

- User Trust and Brand Reputation: A secure app builds user trust, enhancing the enterprise’s reputation. Awareness of fraud types and implementing measures to counteract them contributes significantly to this trust.

- Innovation in Security Practices: Knowing the evolving nature of fraud encourages innovation in security solutions, keeping developers ahead in the cybersecurity arms race.

- Financial Stability: Preventing fraud is critical to avoiding financial losses due to unauthorized transactions, fines, and compensations associated with breaches.

- Proactive Security Measures: Understanding these techniques enables developers to proactively incorporate security measures into their applications rather than reacting to breaches after they occur.

- Cost-Effective Development: By understanding and integrating these techniques from the onset, developers can avoid the higher costs of rectifying security breaches post-deployment.

A thorough understanding of the types of fraud in mobile applications is foundational for developers. It informs the development of more secure, reliable, and user-trusted mobile applications, safeguarding the interests of both the users and the enterprise.

Key Techniques of Online Fraud Detection

Online fraud detection in mobile applications is critical to mobile security, particularly for developers. Here, we explore the essential techniques employed in fraud detection, focusing on their technical aspects and implications for developers.

- Machine Learning and AI Algorithms: Machine learning and AI algorithms use artificial intelligence and machine learning to analyze data patterns and detect anomalies indicative of fraudulent activities. Algorithms can be trained to recognize patterns typical of fraudulent transactions or behaviors. Integrating AI and machine learning algorithms requires a strong understanding of data science and analytics. Developers must be able to gather and process large data sets, train models effectively, and continually refine them based on new data.

- Behavioral Analytics: Behavioral analytics analyzes user behavior within the app to identify actions that deviate from the norm. It involves monitoring how users interact with the application, including login patterns, transaction behaviors, and navigation patterns. Implementing behavioral analytics necessitates collecting and analyzing user interaction data within the app. Developers must ensure privacy compliance while collecting such data and implement systems that can process and analyze this data in real time.

- Biometric Authentication: Biometrics, such as fingerprint scans or facial recognition, provide a secure user identification method, making unauthorized access more difficult. Developers need to integrate biometric authentication features into their applications, ensuring compatibility with a wide range of devices while maintaining the privacy and security of biometric data.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second form of user verification, typically a code sent to the user’s phone or email. Incorporating 2FA requires developers to implement additional steps in the authentication process. Additional steps include setting up secure communication channels for sending verification codes and ensuring a seamless user experience.

- Secure Communication Protocols: Using HTTPS, SSL/TLS, and other secure protocols ensures that data transferred between the user and the server is encrypted and protected from interception. Developers must ensure that all data transmissions within the app are secured using these protocols. Data transmission security includes user data and communication with APIs and third-party services.

- Regular Security Audits and Penetration Testing: Regularly auditing the application for vulnerabilities and conducting penetration testing helps identify and rectify security weaknesses. Developers must be versed in security auditing and penetration testing techniques. They should also be prepared to respond quickly to any vulnerabilities discovered.

A deep understanding of online fraud detection techniques is essential for mobile application developers. This knowledge enhances the security and integrity of the applications. It aligns with business objectives, regulatory requirements, and user expectations in the rapidly evolving mobile app development and security landscape.

Important Emerging Trends in Online Fraud Detection

In the rapidly evolving landscape of online fraud detection, staying abreast of emerging trends is crucial for mobile application developers and security professionals. These trends reflect the changing nature of online threats and dictate the direction of security strategies. Here’s an exploration of the key trends in online fraud detection and their relevance to mobile application and device security.

- Artificial Intelligence and Machine Learning: Integrating AI and machine learning in fraud detection systems is becoming increasingly sophisticated. These technologies can analyze vast amounts of data to identify patterns and anomalies indicative of fraudulent activities. Understanding AI and ML algorithms enables developers to implement predictive fraud detection mechanisms, making applications proactive rather than reactive in identifying potential threats.

- Behavioral Biometrics: Beyond traditional biometrics, behavioral biometrics such as keystroke dynamics, mouse movements, and touch patterns are gaining traction. They provide a more dynamic and continuous form of user verification. Incorporating behavioral biometrics can enhance the security of mobile applications by adding a layer of passive, continuous authentication that is difficult for fraudsters to replicate.

- Multi-Factor Authentication (MFA) and Adaptive Authentication: MFA is becoming more sophisticated with adaptive authentication, where the level of authentication required changes based on the risk profile of the transaction or activity. Developers must understand how to integrate adaptive authentication seamlessly into mobile applications, enhancing security without compromising user experience.

- Blockchain Technology: Blockchain is being explored for its potential in fraud prevention, particularly in securing transactions and maintaining transparent, tamper-proof records. Understanding blockchain technology can be vital for developers to develop decentralized applications (DApps) or integrate blockchain-based security features, especially in the finance and supply chain sectors.

- Cloud-Based Fraud Detection Systems: Fraud detection systems can now leverage cloud computing, processing large datasets more efficiently and providing scalability and real-time analysis. Developers must be proficient in cloud computing and understand how to integrate cloud-based fraud detection services into their applications.

- Regulatory Technology (RegTech): RegTech solutions are emerging to help businesses comply with increasing regulatory requirements around data protection and fraud prevention. Awareness of RegTech solutions can assist developers in ensuring that their applications comply with relevant laws and regulations, reducing legal risks.

- Internet of Things (IoT) Security: With the proliferation of IoT devices, including mobile and wearable technology, there is a growing need to secure these endpoints against fraud. Developers must consider the security implications of IoT integrations in their applications, ensuring these devices do not become weak links in the security chain.

- Deep Learning and Neural Networks: Advanced deep learning techniques and neural networks are being deployed to detect complex and sophisticated fraud patterns. Developers should familiarize themselves with deep learning concepts to implement cutting-edge fraud detection capabilities in their applications.

Understanding these trends in online fraud detection is essential for mobile application developers and security professionals. It allows them to build more secure, resilient applications that can withstand the evolving landscape of online threats. By staying informed and adapting to these trends, developers can protect users and data and gain a competitive edge in the market by offering advanced security features. This knowledge is integral to developing functional, secure, and trustworthy applications in the eyes of users and stakeholders.

Practical Applications and Examples of Online Fraud Detection Systems

- E-commerce Application: Implementing a fraud detection system that analyzes purchase patterns and flags transactions deviate significantly from a user’s typical behavior.

- Banking Application: Using biometric authentication and machine learning to detect and prevent unauthorized access to user accounts.

- Enterprise Internal Apps: Implementing role-based access controls and monitoring employee activity to prevent insider fraud.

For mobile app developers working on enterprise-level applications, integrating robust online fraud detection mechanisms is not just a feature but a necessity. It involves a comprehensive approach, combining technological solutions, user education, and continuous vigilance. The aim is to create a secure digital environment that protects both the users and the organization, maintaining the integrity and trustworthiness of the mobile application.